What's Full Coverage Automobile Insurance?

Table of Content

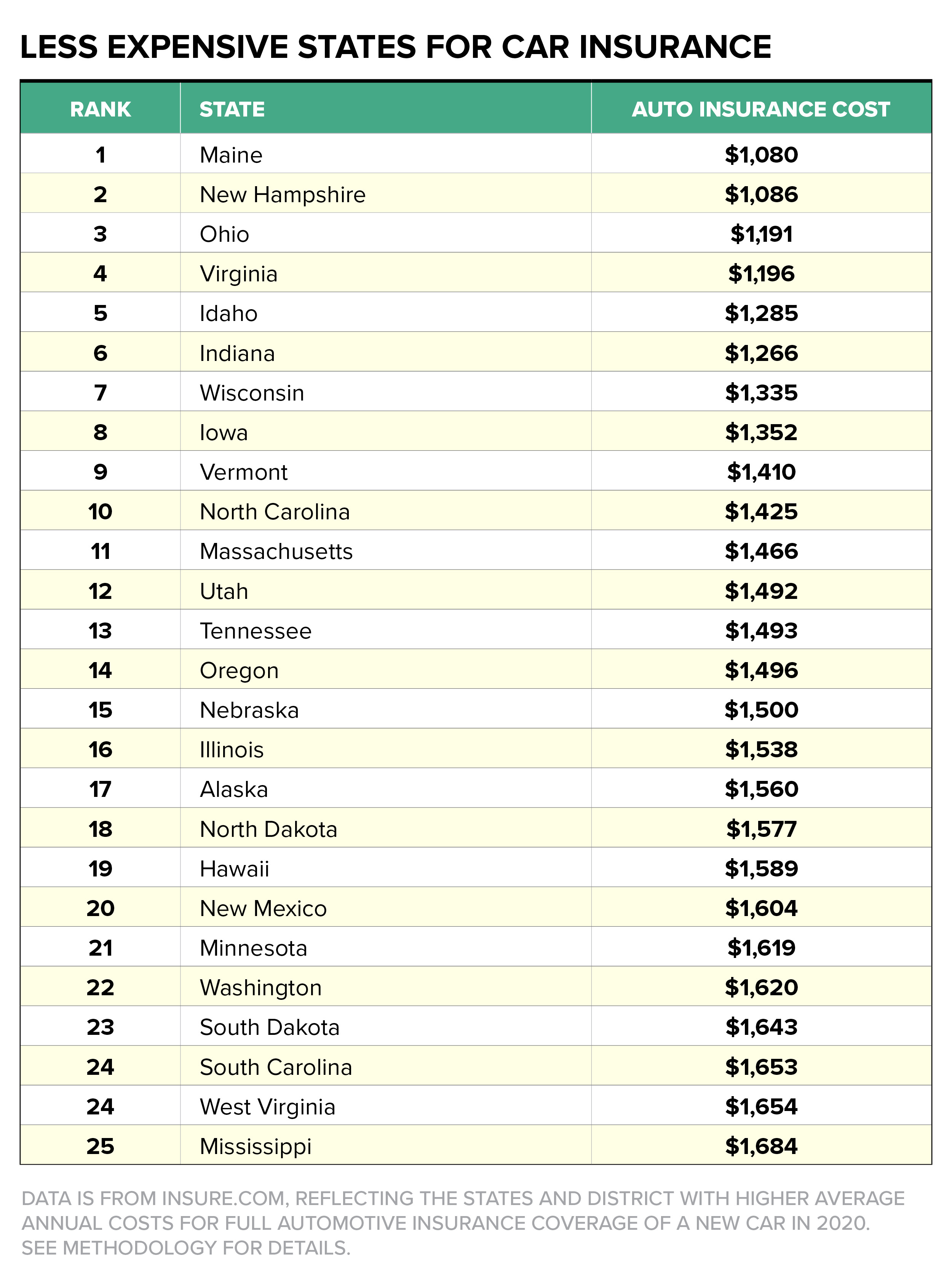

Full protection automotive insurance coverage costs $1,682 a yr on average, based mostly on the profile of a 40-year-old male driver with clear driving document and good insurance coverage rating. To calculate full coverage charges, insurers think about how typically individuals in your space file insurance coverage claims, how a lot those claims value, and the frequency of theft and vandalism, among other factors. With full coverage auto insurance coverage, you may have extra protection on the road in comparison with a coverage that only has the minimum required coverage amounts. If you get into an accident and do not have the right insurance or sufficient coverage, you could have to pay for property injury or bodily injury claims out of pocket. Our charges for minimal protection insurance policies represent the average cost of a policy that solely meets a state's minimal requirements for auto insurance protection. No insurance coverage policy can cowl you and your car in every possible circumstance, however full protection protects you in most of them.

Here’s a take a glance at what’s included in the three types of protection. The minimum car insurance required in Louisiana is $15,000 for bodily injury liability per person, $30,000 for bodily injury legal responsibility per accident and $25,000 for property harm legal responsibility. This table shows the typical costs for full-coverage automotive insurance coverage insurance policies for 35-year-old female and male drivers in New Orleans. However, USAA insurance coverage is only obtainable to army members, veterans and their instant household. Car insurance quotes by weighing numerous components, corresponding to age, marital status, gender and driving history.

Full Coverage Automotive Insurance Price In 2022

Consumers can easily equate the difficulties and bills brought on by their smartphone breaking to the know-how in their car, he stated. Ally, APCO, JM&A and AUL are a couple of providers providing distinctive car tech-specific protection plans. As automobile expertise advances, protection of electronics solely has emerged as an different selection to full vehicle service contracts. The protection is geared toward customizing protection for technology that's usually changed rather than repaired, which might cost a driver 1000's of dollars. Nupur Gambhir is a content editor and licensed life, health, and incapacity insurance coverage skilled.

Many or all the products featured listed right here are from our partners who compensate us. This might influence which products we write about and the place and how the product seems on a page. Here is a list of our partners and here's how we make money.

Does Full Protection Insurance Cover Repairs

If you're skilled and certified to supply a service or enterprise, similar to a monetary advisor, accountant, physician, lawyer or dentist, you have to have a professional charge. When clients undergo monetary loss as a result of insufficient or incomplete service on behalf of your company, you are at risk of being sued. This covers your car when it is damaged in a collision with an object or another vehicle. It will also cover your car if it is involved in a single rollover accident. Damage to your car, as a lot as the honest market worth, minus the deductible determined in your coverage if you're at fault, or if the other driver involved within the accident doesn't have insurance.

Full protection insurance covers at fault accidents for both accidents and damages to others and for harm to your automobile. It doesn’t cowl your individual injuries in an at-fault accident except personal injury safety is added (it’s required in some states and elective in others). Truthfully, there is no such thing as "full coverage"; full coverage auto insurance coverage isn't a selected kind of coverage or coverage.

What Does Full-coverage Pay For?

It's not a serious portion of enterprise, but its coverage count has tripled since October 2021 and is rising in reputation, in accordance with Gabe Garroni, Ally's vp of gross sales. Misconceptions about what a tech-only product covers can leave a client unsatisfied; nevertheless, May noted the group's sellers who do promote it, promote it properly. However, tech protection is appealing as a end result of technology components usually are not solely expensive but additionally not a do-it-yourself job, he mentioned. The latest launch is TechCare, a product by EasyCare, an APCO Insurance brand. Launched in September, TechCare protects in-vehicle expertise such as cameras, speakers and screens, in addition to automobile security options.

Pairing this with the struggles of paying off a car loan within the first place, it could possibly make driving and shopping for insurance coverage unnecessarily exhausting. Make certain you attain out to Worth Insurance so we can help you get quick and aggressive automotive insurance quotes, guaranteeing that you are getting your money’s worth. If you're driving a financed automotive, you continue to need to have full protection.

Drivers in Louisiana, Washington, DC and New York pay lots. Injuries and property damage you cause to others, up to your chosen limits. Available in most states, this type of coverage may cowl the value of towing and roadside labor. This benefit offers emergency roadside help for particular events, such as, flat tire, lockout, lifeless battery, or working out of fuel. Regardless of who’s at fault, collision can pay for harm to your automobile should you hit another vehicle or object, another automobile hits you, or your automobile rolls over.

These components embrace you’re the model 12 months, the inclusion of safety options, reliability report, and the value of restore and substitute elements. You'll get much less protection from the insurer, however the trade-off could also be price it, relying on your private scenario. Given that a full protection insurance coverage coverage is 2 and a half instances as expensive as a liability-only coverage, you will need to make sure the extra value is worth it. Is the most cost effective widely available firm within the country for full protection policies with a mean fee of $1,310 per year, or $109 per 30 days. After paying off your complete car mortgage, you want to keep in mind to contact your insurance coverage firm. That means, you'll have the ability to remove your lender as a lienholder of your automobile.

You shall be lined for auto accidents as well as losses attributable to vandalism, extreme weather, hearth, or theft. The average value of automobile insurance coverage in New Orleans is much higher than the national average even if you’re an excellent driver with a clean document. The cheapest automotive insurance companies in New Orleans are typically Southern Farm Bureau, USAA, Geico, State Farm and Progressive. Though gender doesn’t have a big effect on common automotive insurance charges, girls usually pay a little less than men for coverage. Male drivers are statistically more more likely to get into accidents, so their common charges are often barely higher, especially when they’re in their teens and early 20s.

Insurance deductible, an amount you’re anticipated to pay out of pocket toward repair or alternative. That's why you should at all times make certain you can afford to pay the deductible before you make a declare. Repair prices to your car if you crash with another automobile or run into an object, such as a tree or a phone pole. Medical costs as a outcome of injuries or deaths from an accident you caused.

You can have peace of mind figuring out Nationwide will provide you and your automotive with great safety on and off the highway. Even with full coverage, there are different coverage choices you may need. For instance, roadside assistance, gap insurance and medical funds insurance all pay for expenses full protection automobile insurance won’t.

Leslie Kasperowicz is an insurance coverage skilled with four years of direct company experience and over a decade of creating instructional content material to help insurance shoppers make confident, informed selections. Make certain your insurance retains up together with your life and you get all the reductions you deserve. And if you’re involved in an accident, your deductible is reset again to $100 off. Earn $100 off your deductible for each year of secure driving, up to $500.

Comments

Post a Comment